Injection Machines

6Performance-driven injection molding machines.

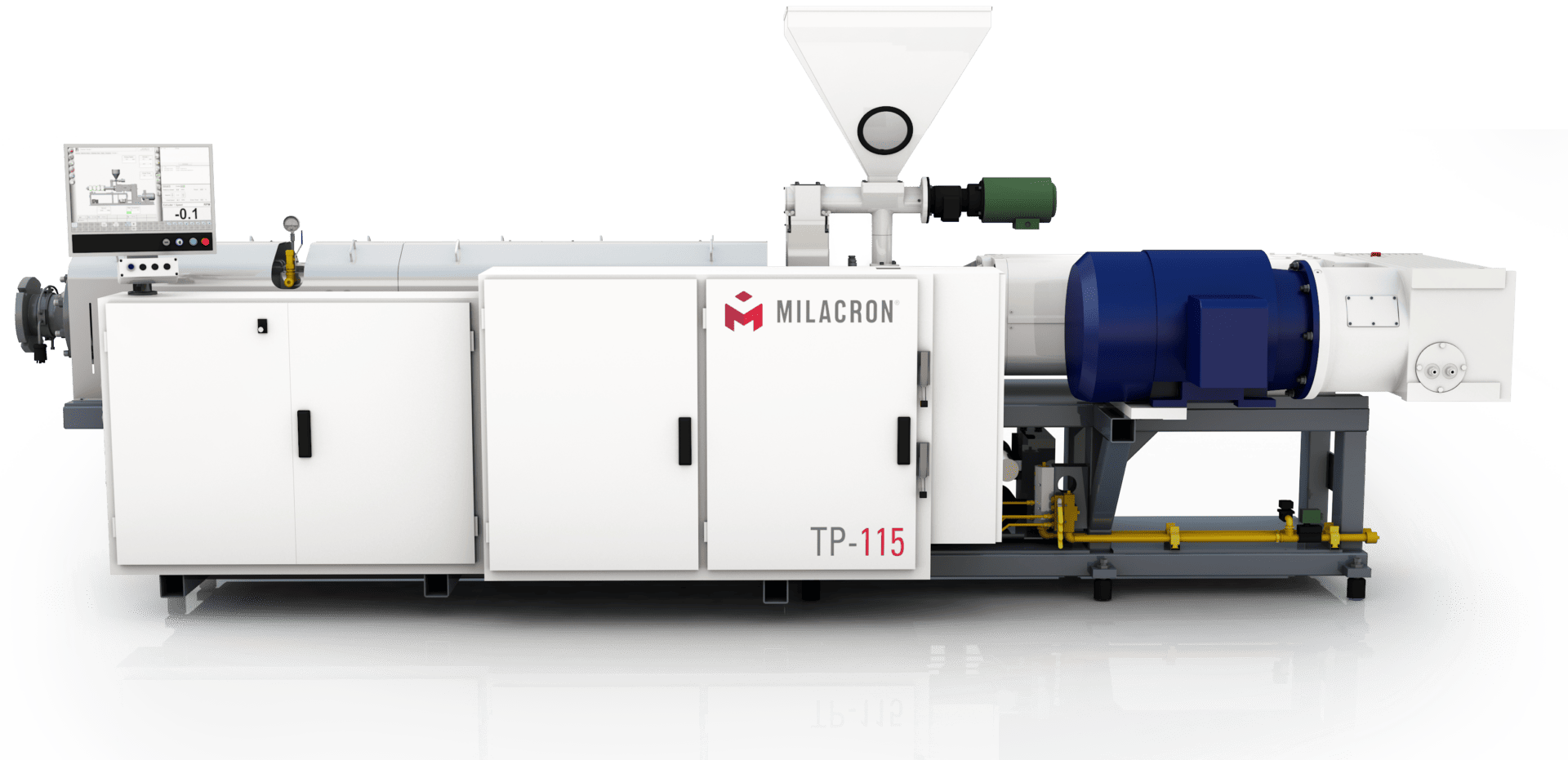

Extrusion Machines

3Versatile plastic extrusion systems.

Auxiliary Equipment

6Streamlined automation solutions for every step in plastics manufacturing.

Parts & Service

5Parts, Service, Digital, and Rebuild & Retrofit.

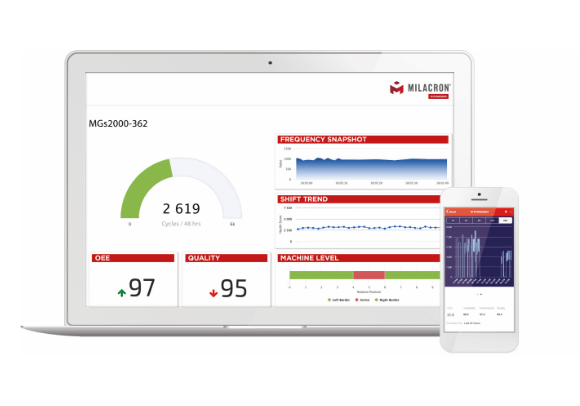

Digital Solutions

1IIOT Platforms that turn data into a competitive advantage.

Tech Support

Training and service designed to minimize downtime and improve efficiency.