Milacron News

Press Release

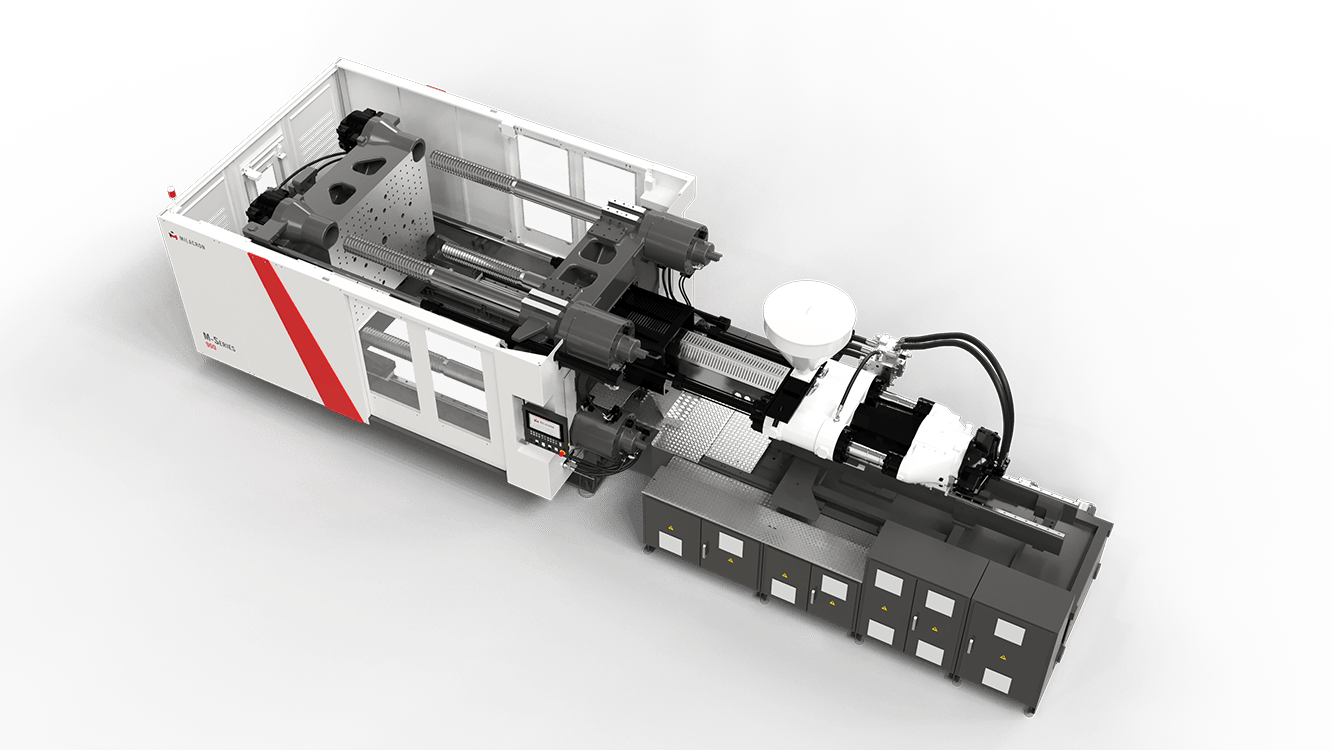

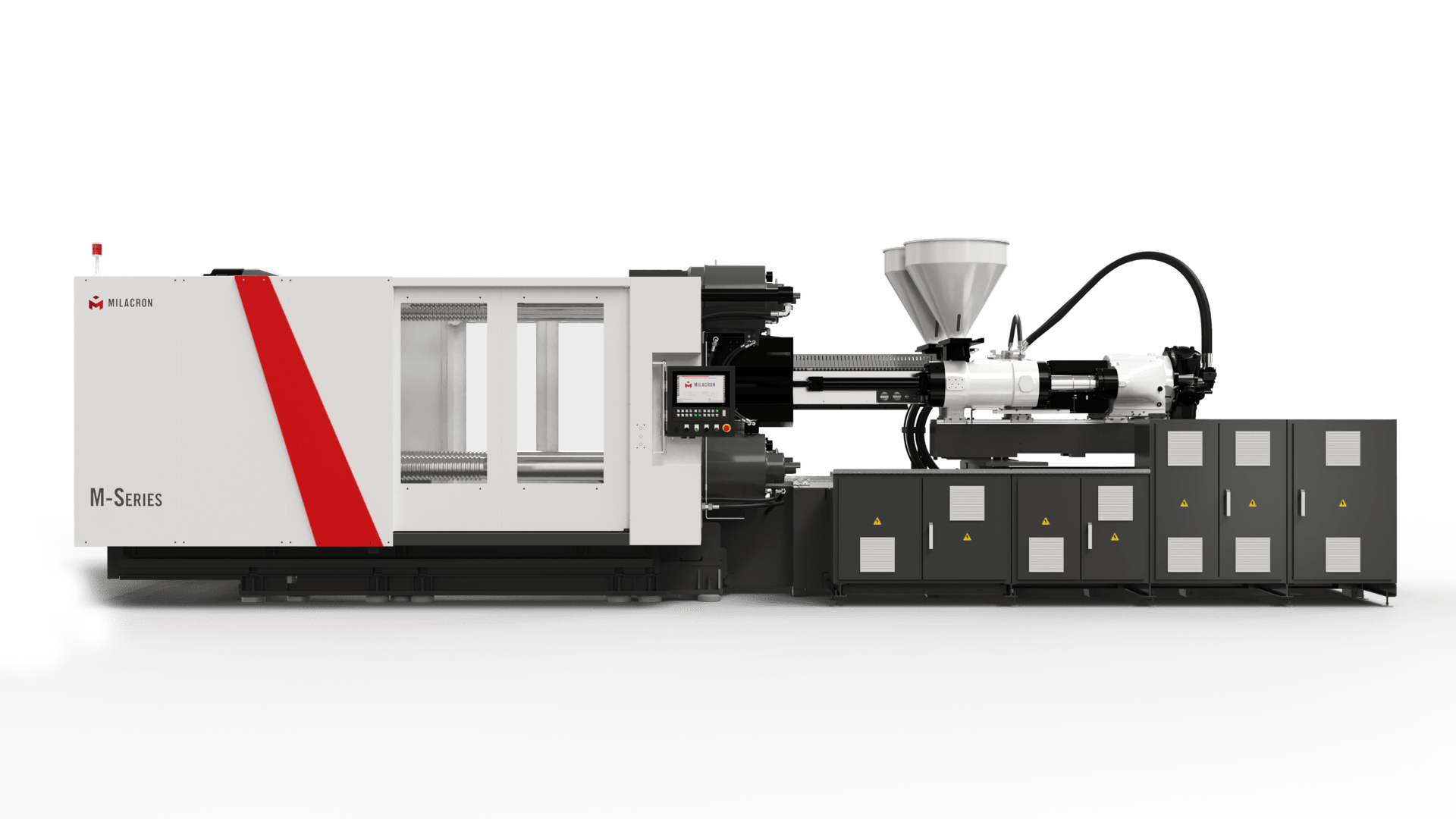

MILACRON UNVEILS AN INNOVATIVE LINEUP FOR NPE 2024 THAT LEVERAGES INDUSTRY-LEADING SERVICE, TECHNOLOGY AND SOLUTIONS IN BOOTH W1601

April 1, 2024

A new universal injection molding platform, progressive co-injection technology, an 85-foot extruder line with live cobot demonstrations, in-mold foil decorations, […]

Showing 0-6

Of 37 Items